Crypto lending

Lending assets on Aave

Abra has developed an easy-to-use app for managing investments in crypto currencies. Their use of multi-sig technology in bitcoin and litecoin to create investment contracts is quite powerful. That they have done it in a super user-friendly way is commendable. Lend crypto According to the SEC’s order, in or around June 2020, Nexo began to offer and sell the EIP in the United States. The EIP allowed U.S. investors to tender their crypto assets to Nexo in exchange for Nexo’s promise to pay interest. The order states that Nexo marketed the EIP as a means for investors to earn interest on their crypto assets, and Nexo exercised its discretion to use investors’ crypto assets in various ways to generate income for its own business and to fund interest payments to EIP investors. The order finds that the EIP is a security and that the offer and sale of the EIP did not qualify for an exemption from SEC registration. Therefore, Nexo was required to register its offer and sale of the EIP, which it failed to do.

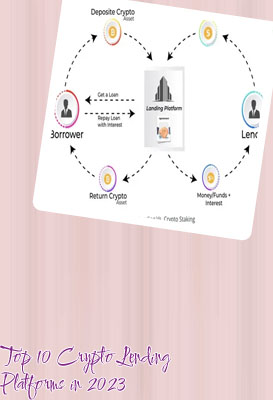

How to lend crypto

The Atlendis World has been designed to embrace the values of decentralization, and transparency on Atlendis translates into sustainable yields for lenders - what you see is what you get. Your assets are put to work before, during and after your funds have been borrowed. Lenders have granular control over their portfolios and their risk compared to uncollateralized and undercollateralized lending platforms that use shared liquidity pools. Borrowers benefit from dedicated revolving lines of credit and the flexibility to access capital. NBX is a trusted Norwegian exchange, where you can buy and sell cryptocurrency easily and securely. Buy Bitcoin, Ethereum, Cardano and other tokens with card. Invest in your future now. Aave is an Ethereum-based DeFi protocol that offers various crypto loans. You can both lend and borrow, as well as enter liquidity pools and access other DeFi services. Aave is perhaps most famous for its work in popularizing flash loans. To lend funds, you deposit your tokens into Aave and receive aTokens. These act as your receipt, and the interest you earn depends on the crypto you are lending.Guide to Crypto Lending and DeFi Platforms

There are thousands of different cryptocurrencies available. According to crypto news outlet CoinDesk, here are the top five in terms of market capitalization: Get crypto news straight to your inbox-- The precise legal status of crypto lending might vary based on the country in which it is performed; however, crypto lending is generally lawful. In some countries, there may be rules or limits on crypto lending, like needing a license or registering with the right authorities. It is important to find out if crypto lending is legal in your country and to follow any laws and rules that apply.